how does refinancing a home loan work and what to expect

Big picture

Refinancing replaces your existing mortgage with a new one, ideally at a lower rate or on better terms. The process mirrors your original loan: you apply, the lender reviews credit and income, orders an appraisal, and, if approved, you close on the new note to pay off the old one.

Why people refinance

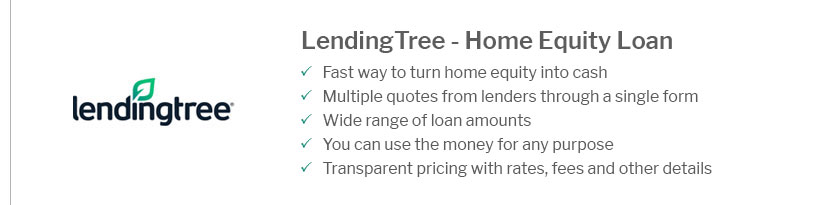

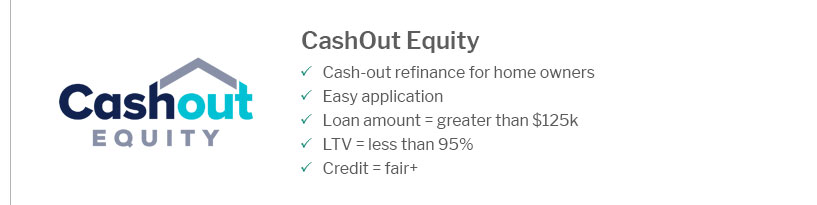

Lower payments, faster payoff, or tapping equity are common goals. You might switch from an adjustable rate to a fixed rate for stability, or shorten the term to save on lifetime interest. Be sure to compare the APR, not just the headline rate.

Steps and costs

Expect closing costs-origination, appraisal, title fees-which can be paid upfront or rolled into the balance. A simple rule: if savings exceed costs within your planned time in the home, refinancing may make sense.

- Check your credit and current rate-versus-market.

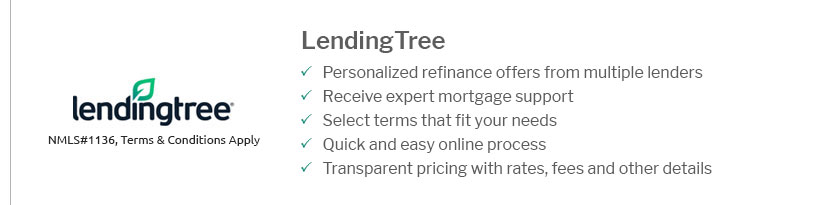

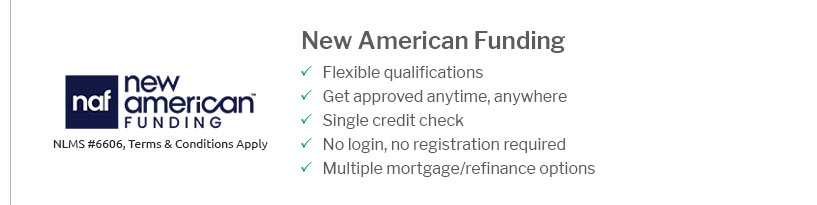

- Shop multiple lenders and request loan estimates.

- Run a break-even analysis on fees versus monthly savings.

- Lock your rate, submit documents, and prepare for appraisal.

- Review closing disclosures carefully before signing.